Pursuant to the adoption of the 2030 Agenda for Sustainability Development with 17 Sustainability Development Goals by the United Nations (“UN”) in 2015, the International Maritime Organisation (“IMO”), as part of the UN, has since established several important targets related to these SDGs. These targets, amongst many others, include the 0.5% global sulphur cap coming into force from 1 January 2020 and the reduction of greenhouse gas (“GHG”) emissions by at least half before 2050 compared to 2008, reduction of average carbon emissions of 40% by 2030 and then 70% by 2050 from 2008.

The IMO working group for GHG emissions agreed in a recent November meeting in London to opt for a mandatory goal-based approach to reduce shipping’s carbon emissions. The IMO Action Plan includes further strengthening existing regulations and introducing new supporting measures to reduce plastic litter from ships.

This opens up new opportunities for players to build resilience in their business. Business resilience can be better developed and communicated in the form of sustainability reporting to key stakeholders. The language of sustainability covers 3 key dimensions - people, planet, and prosperity and can be organised in the form of environmental, social and governance (“ESG”) factors.

The identification of material ESG factors allows companies to channel their sustainability efforts to areas that matter most. From the investor’s perspective, ESG factors help to better predict the fundamentals and performance of the company. As such, it is of paramount importance for the company to be able to tell investors and key stakeholders about its business directions, efforts, and corporate DNA. Common disclosure topics include corporate governance, greenhouse emissions, business ethics and integrity, anti-corruption practices, employee development and safety, management of technology risks, and diversity. Let us look at three (3) widely discussed ESG factors and the need to establish policies, practices, and performances of these factors.

1. REDUCTION OF GREENHOUSE EMISSIONS

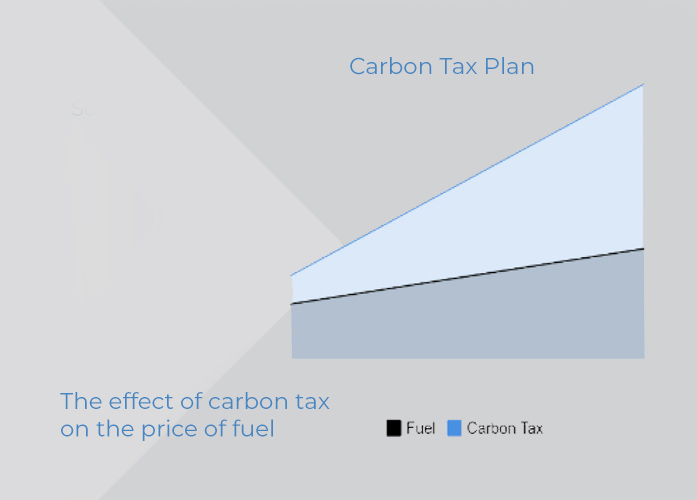

The path towards decarbonisation is fraught with obstacles ranging from the availability of low carbon fuels, the suitability of marine equipment for these low carbon fuels, ship design, and an appropriate carbon pricing system. With Mr. Andreas Sohmen-Pao pushing for a $70 billion carbon tax plan and saying that we should not be on the wrong side of history on this one, it will be wise to heed his call. At the suggested starting rate of $10 per tonne of CO2 emitted and $50-$70 per tonne by 2030, this is estimated to add another $30 to $225 per tonne to the price of fuel.

The first step is to start tracking the carbon footprint of the business. The emissions of other GHG covered in the Kyoto Protocol should be similarly tracked and managed actively. An internal corporate carbon pricing or GHG pricing can be set to allow shadow pricing to be calculated and evaluate the impact on operating results. Using big data, powerful scenarios analyses can be made and meaningful evaluation can be done over what energy sources to use to comply with IMO’s requirements.

The average Energy Efficiency Design Index (“EEDI”) for new ships can also be established and disclosed. Energy and fuel consumption, emissions and pollution management, carbon offsetting and waste management efforts can be described and disclosed. The internal management systems will also need to be developed so that data can be identified, captured and reported. As the saying goes “If you cannot measure it, you simply cannot manage it.”

Innovation has emerged due to mandatory requirements enacted by IMO and various jurisdictions. While the jury is still out on LNG as a clean fuel, new research and development efforts on new energy sources like those of Maersk and Wallenius Wilhelmsen joining hands to develop a lignin and ethanol blend as a low carbon fuel solution will also be of interest to key stakeholders. So will the use or non-use of green fuel and green technology by your business.

The comparability of ESG data remains a huge barrier in generating a meaningful return difference between companies with stronger ESG management/reporting and those who are average. The Poseidon Principles, Green Loan Principles, and the Sustainability Linked Loan Principles all point towards a change in focus by the banks and investors. The Green Ship Finance Deal of the Year was awarded to Sovcomflot for the $252 million nine-year Green Finance Credit Facility to finance its nine (9) LNG-powered Aframax tankers. In October 2019, Teekay Shuttle Tankers successfully placed $125 million senior unsecured Green Bonds for its four (4) new lowemission vessels for the Norwegian North Sea. The tide of ESG investing and green financing is undeniably rising.

To put wind in the sails and catch the tide, one can look at the adoption of Task Force on Climate Related Financial Disclosures to improve sustainability literacy and better align disclosures with the needs of investors, lenders, insurers and other stakeholders. The Maritime and Port Authority of Singapore (“MPA”) launched the first Maritime Sustainability Reporting Guide in August this year. The Maritime Sustainability Reporting Guide can be used to help shipping companies embark on its sustainability reporting journey.

2. MANAGEMENT OF TECHNOLOGY RISKS

Successful sustainability developments call for collaboration among partners and a rapid move towards innovation in maritime technology.

This is the era of the 4th industrial revolution driven by technology everywhere. Talk about big data, big tech and artificial intelligence happens all the time. The ability to harness new technology and manage data/cybersecurity risks has become critical in building business resilience. However, new threats from cybersecurity risks, data management risks, and technology operation risks can also quickly wash one overboard.

The Maritime and Port Authority of Singapore (“MPA”) has recently launched various labs to test new technologies and concepts such as the Next Generation Vessel Traffic Management System and will soon be launching the “digitalPORT@SG”. The first phase of digitalPORT@SG is a one stop clearance for vessel-related transactions of all arriving and departing ships and is estimated to save 100,000 man-hours per year. The next phase of digitalPORT@ SG is a digital shopfront for the booking of terminal and marine services facilitating optimal vessel passage planning in the port. The aim is to make digitalPORT@ SG interoperable and allow the exchange of ship credentials with other countries for port regulatory activities, thereby enabling greater efficiency among industry players.

Technological innovation presents wonderful opportunities to help reshape the maritime industry. Imagine having the ability to harness the power of technological advancement for device-to-device connectivity and create efficiencies. Embedding the purposeful use of technology in sustainable development goals and everyday operations will create a competitive advantage that others find hard to emulate.

Every ship is essentially a business unit. If onboard systems can be redesigned and greater automation introduced, the whole fleet of vessels will be able to generate better returns. Reimagine the use of technology to make the ships more homogenous, interchangeable and flexible, with enormous live data about the performance of every ship to make new optimisations and adjustments. The goal of unlocking intelligence by opening up data is not a distant future.

Fast-changing technological innovation however, can present other forms of risks. The ever-changing cyber threats come in many forms which are mutating and multiplying rapidly. Security, including cybersecurity, is fundamental to a well-functioning transportation system. The risks of unauthorised access or malicious attack on the ship’s systems and networks grow every day.

IMO Resolution MSC.428(98) identifies cyber risks as specific risks and states that a Safety Management System (“SMS”) should take into account cyber risks management in line with the objectives and requirements of the International Safety Management (“ISM”) code. Plans and procedures for cyber risk management should be established and incorporated into current security and safety risk management requirements in the ISM code and International Ship and Port Facility Security (“ISPS”) Code. Systems should include both onboard systems ranging from cargo management systems, bridge systems, access control systems, communication systems, etc as well as shoreside networks and systems. Vulnerabilities in its systems and onboard procedures should be identified and addressed.

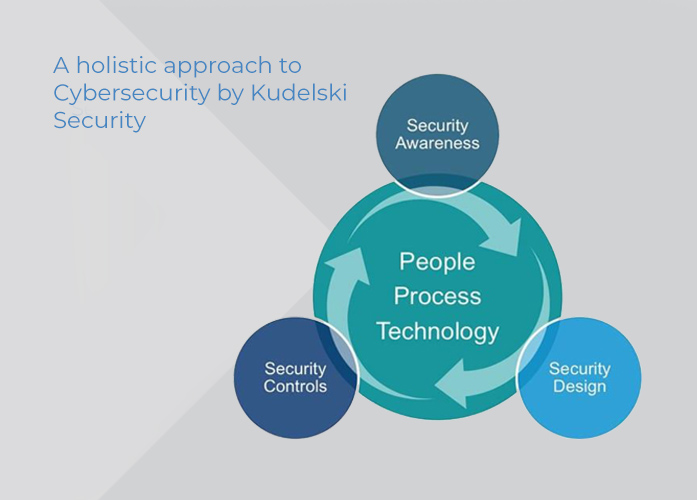

Systematic upgrades to the IT systems and good cyber awareness of the crew/shore-based personnel are critical. It is imperative to have strong contingency and recovery plans in place and to test periodically. It is also recommended that shipping companies relook at their marine property insurance and cover claims caused by cyber incidents and/or cyberattacks. A well-communicated cybersecurity strategy and efforts in the sustainability report will give key stakeholders assurance that the company has a holistic and effective approach to protect its people, its data, its critical information system and operations infrastructure against major disruptions and attacks.

2. DIVERSITY

Diversity ensures a variety of different perspectives and helps one avoid the pitfall of group think. Diversity, like everything else, needs to be managed carefully to see the higher innovation, greater productivity and more profits produced by a diverse talent pool. It is important to have a diversity policy to elucidate the objectives, desired competencies, and guidelines for workplace diversity and inclusion.

The latent labour force of women can be unleashed and further developed as part of the diversity movement in the maritime industry. Shipping has traditionally been a male-dominated industry. IMO promotes gender equality and women’s empowerment and is working with various maritime stakeholders to achieve the SDGs, including SDG 5 – Gender Equality. The World Maritime Day theme for 2019 is in fact “Empowering Women in the Maritime Community”, with IMO Secretary-General Kitack Lim quoted as saying that Empowering women isn’t just an idea or a concept. It is a necessity that requires strong, positive action to address deep-seated structural, institutional and cultural barriers.

While technology has played a big part in levelling the playing field for females, there must be more awareness of the career possibilities in the maritime industry among young women and greater career opportunities for those women already in the industry. There must be concerted efforts and training to curb unconscious bias, especially when making people decisions.

CONCLUDING THOUGHTS

Life in shipping is always tough. Shipping people get criticised for a lot of things which include, amongst many things, damage to the environment, slow adoption of technologies, and the lack of diversity in the community. Green and technology issues are top agenda items for the shipping fraternity, especially the rising Millennials who embrace and are defined by diversity.

We need to reimagine, rethink and rediscover the shipping business in green and be inclusive as we progress. Sustainability reporting is a useful tool for companies to communicate their corporate resilience and ESG efforts, thereby allowing them to tap into the green financing market. In conclusion, there are costs of acting and there are costs of not acting. As Mr. Sohmen-Pao says, we should not be on the wrong side of history on this one.

For further enquiries, please reach out to your Moore Stephens LLP, Singapore representative, or contact the author at the email address below.

laomeileng@moorestephens.com.sg